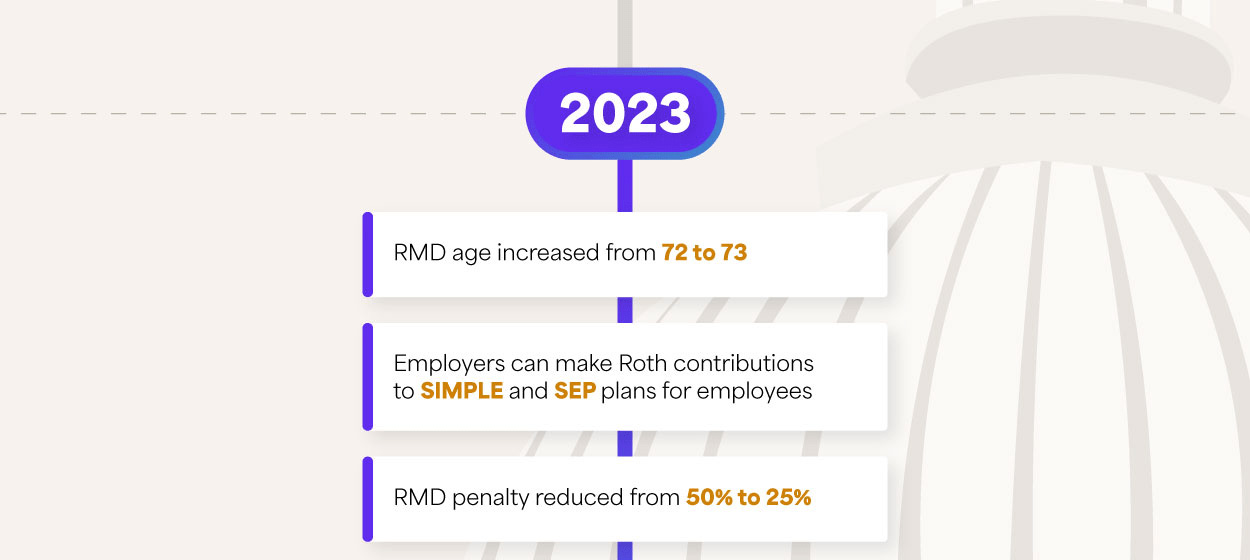

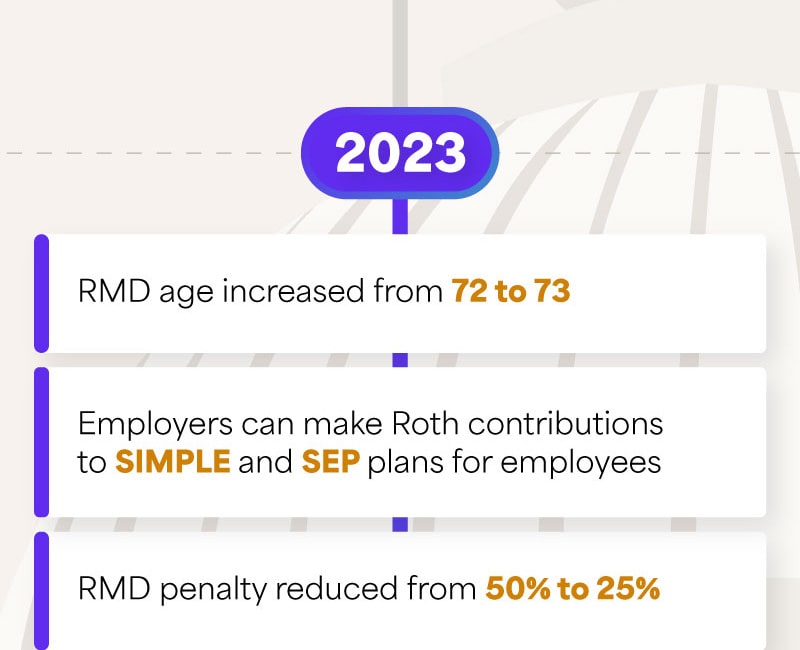

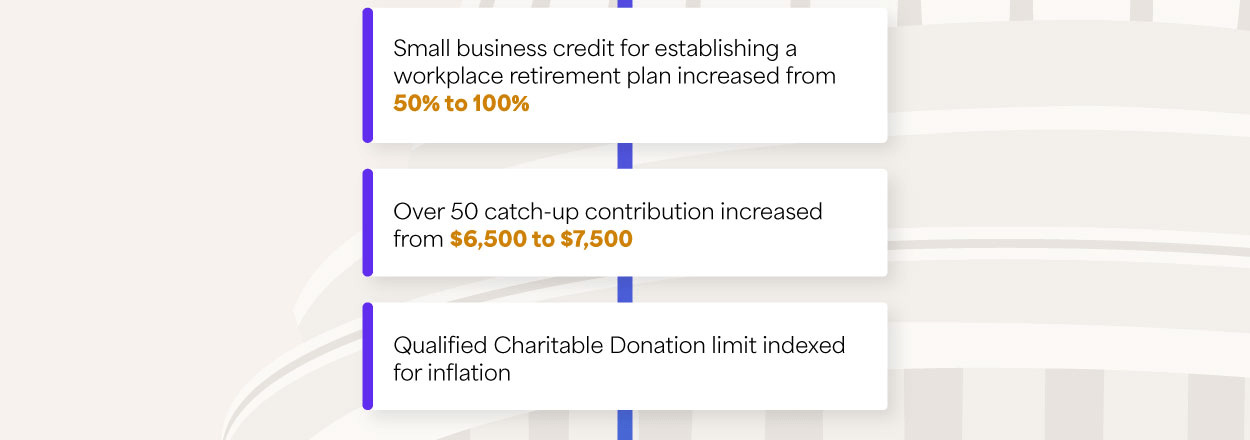

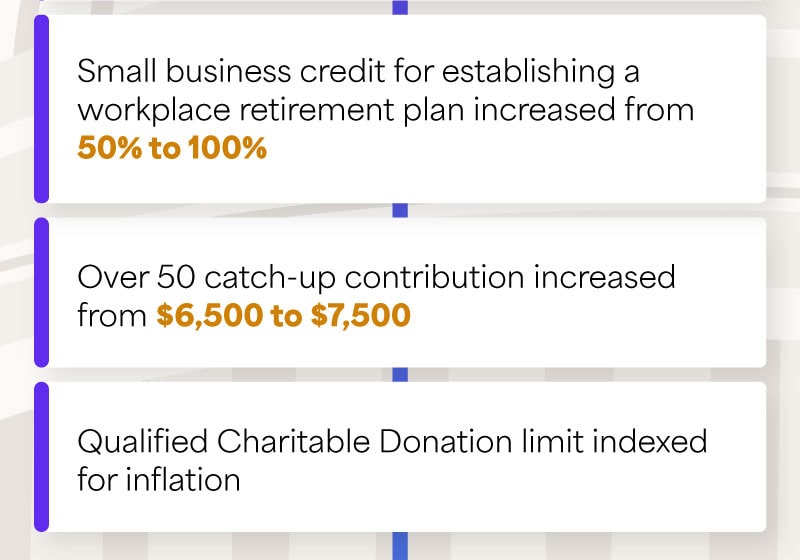

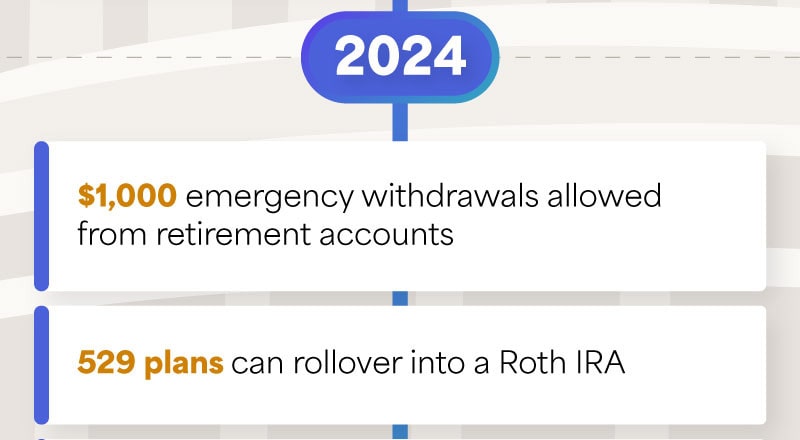

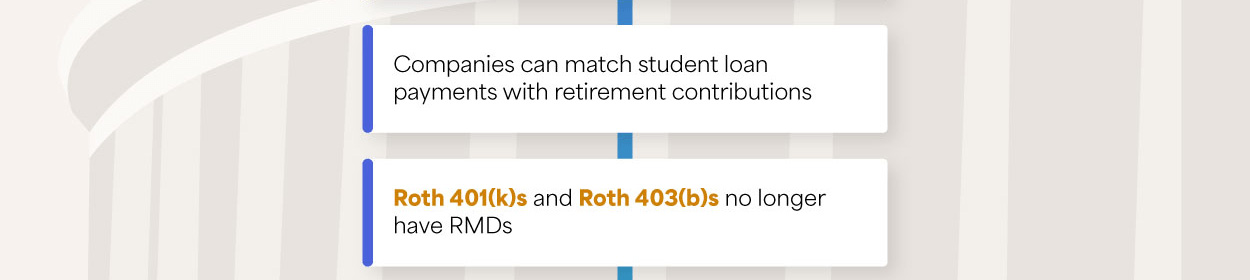

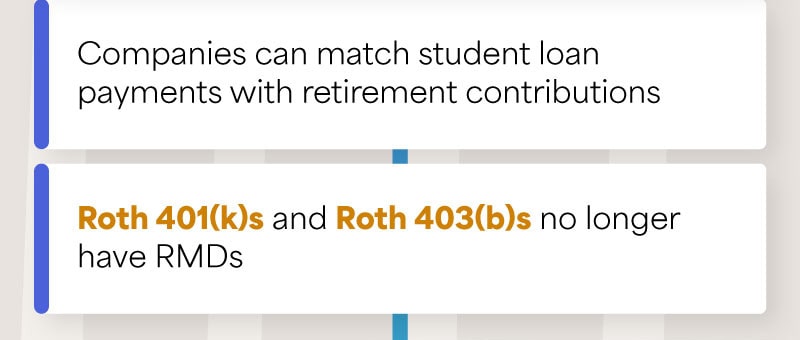

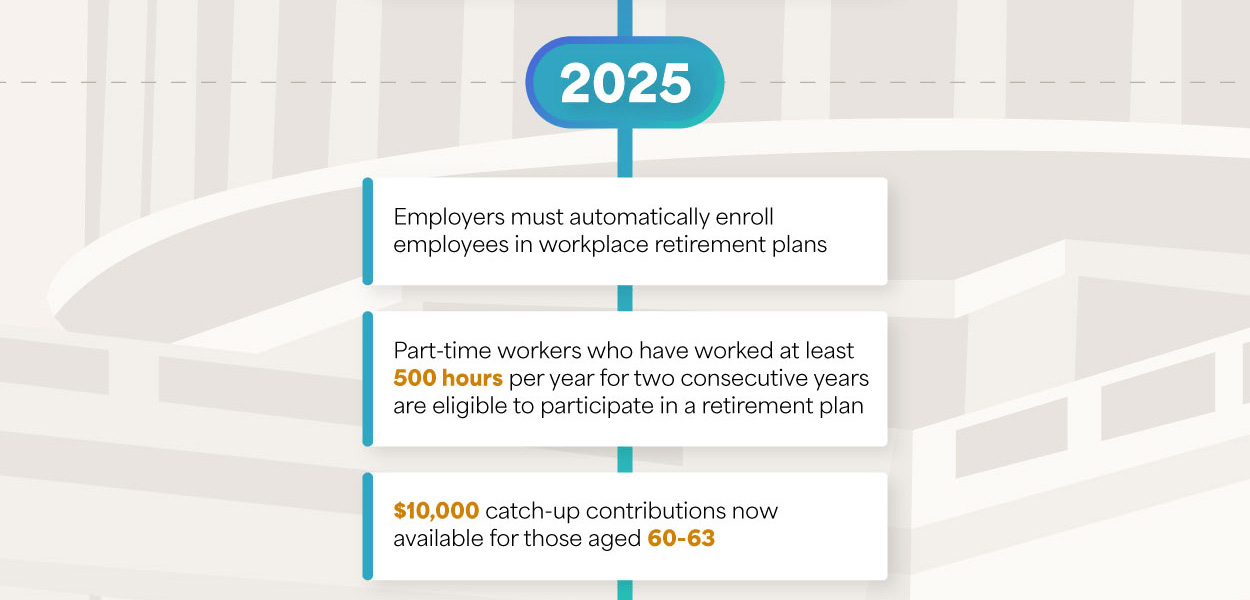

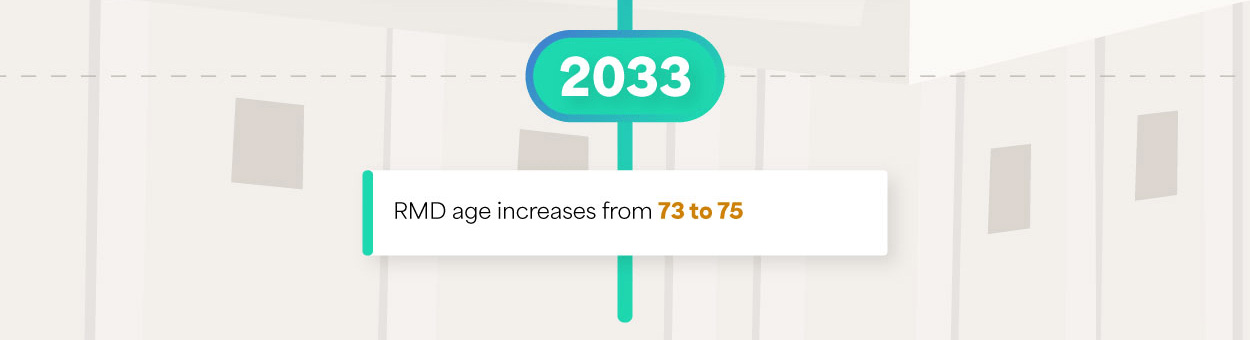

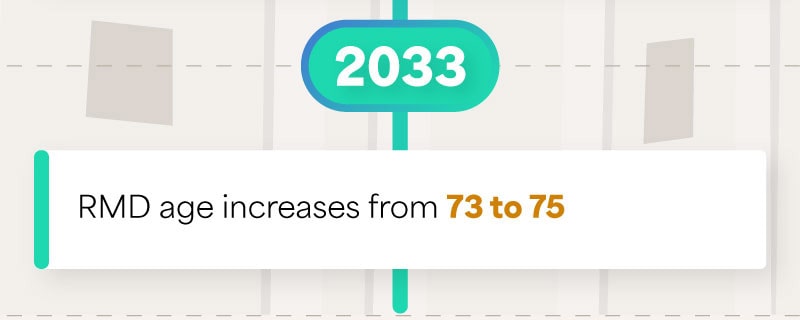

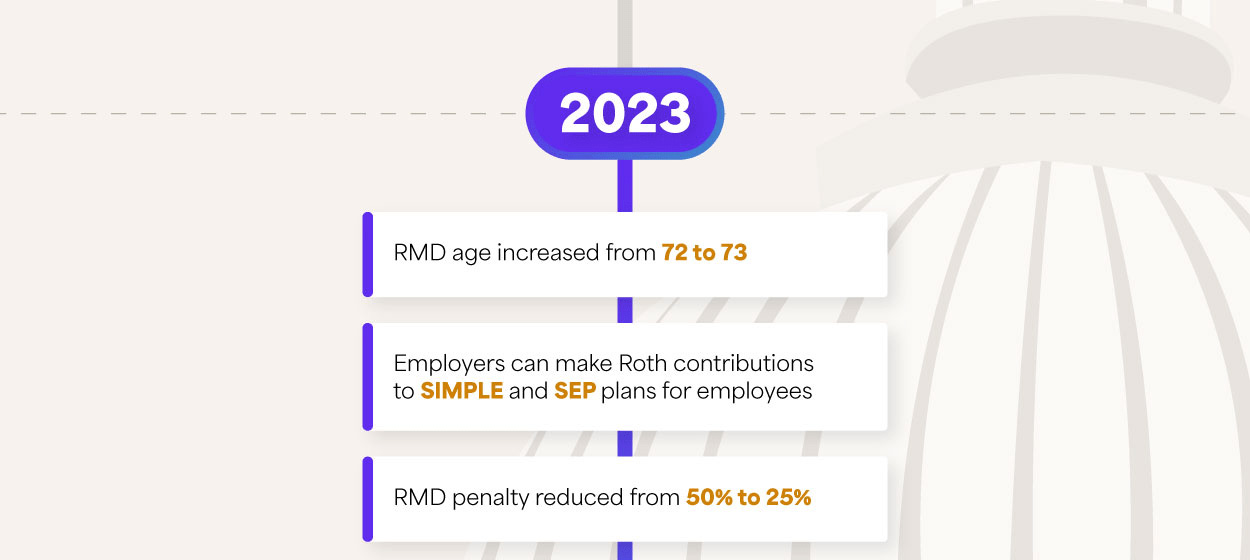

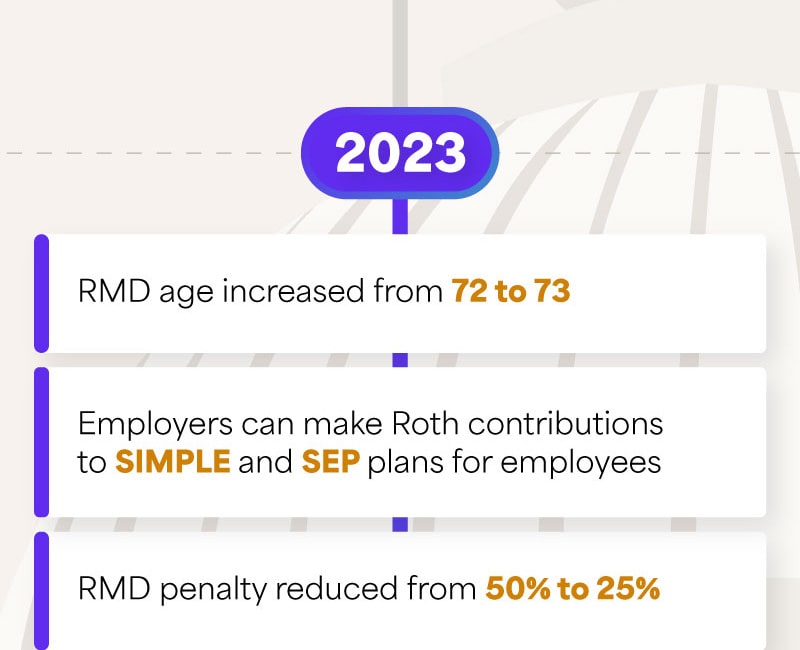

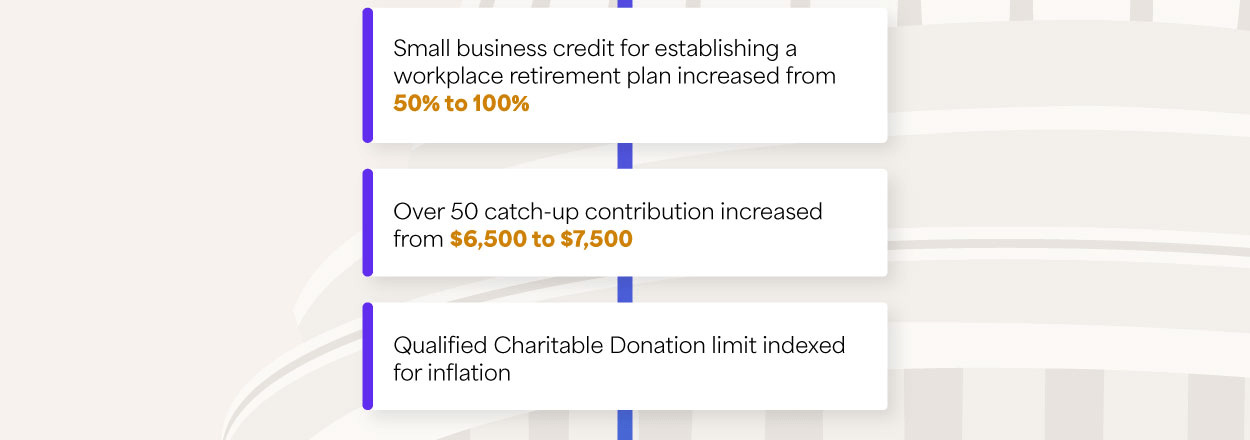

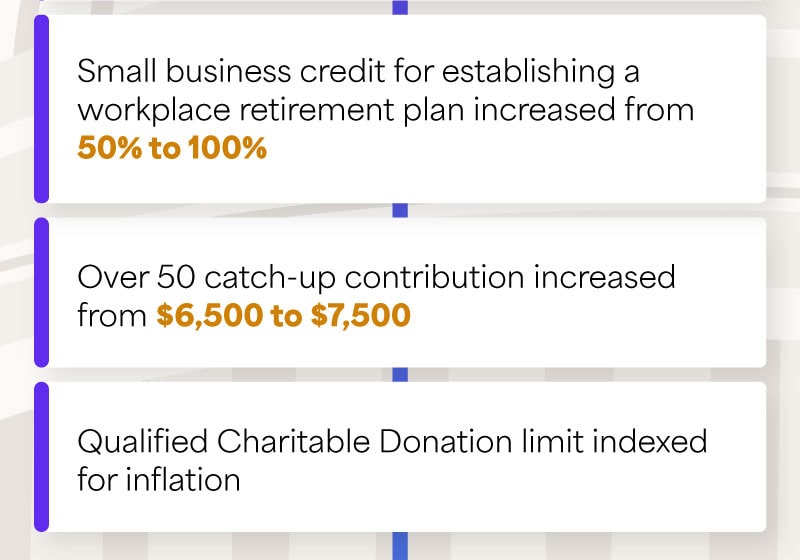

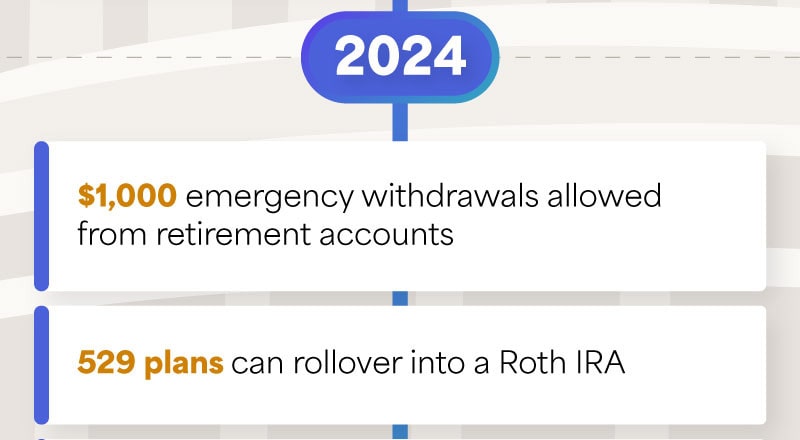

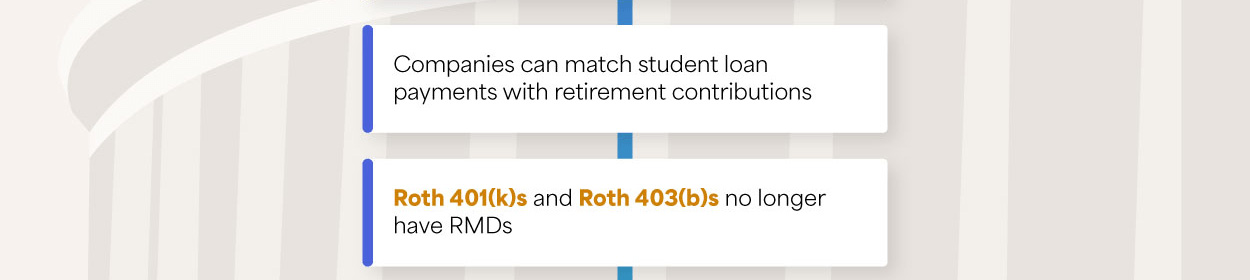

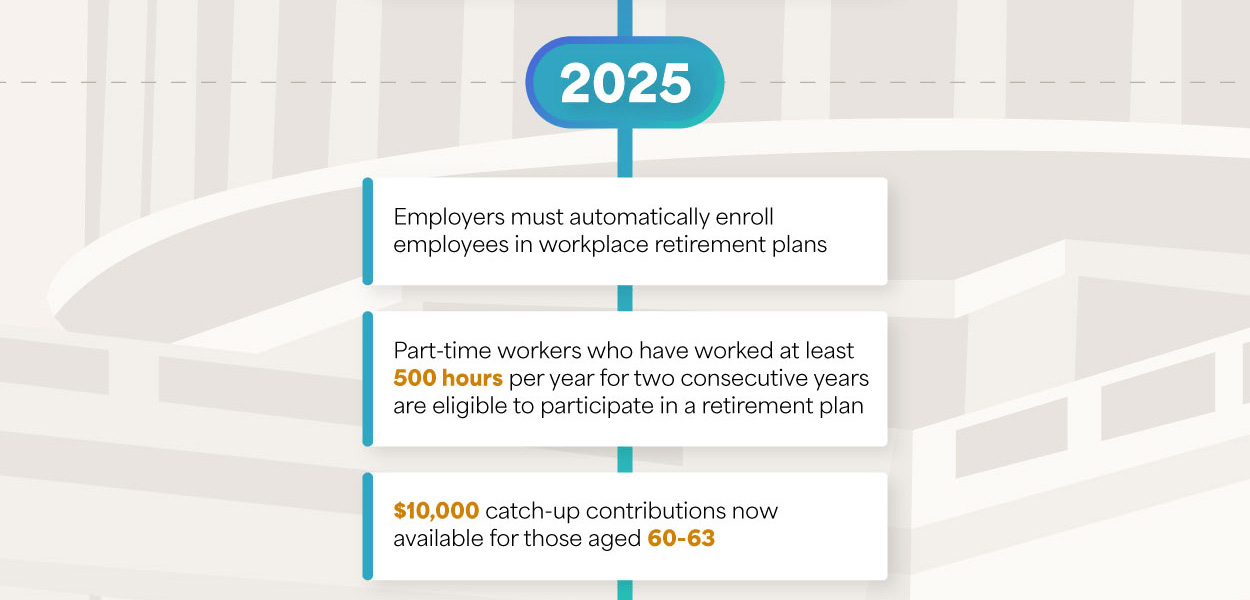

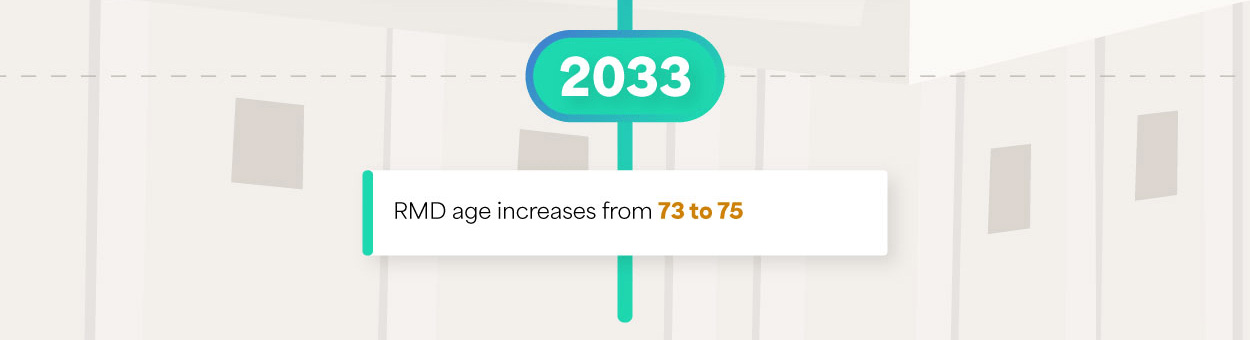

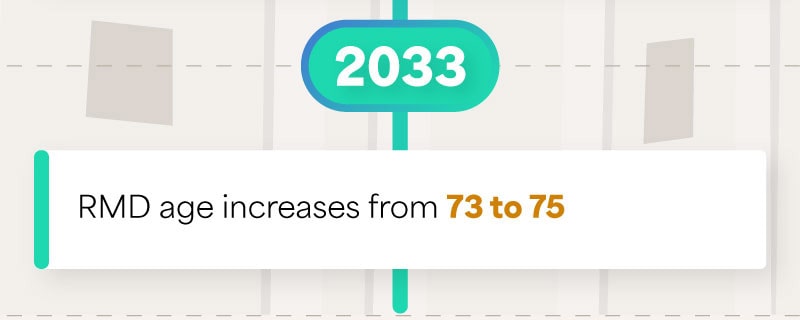

Understanding the SECURE Act 2.0

For many, retirement includes contributing their time and talents to an organization in need.

The federal government requires deceased individuals to file a final income tax return.

Net Unrealized Appreciation and how it affects tax responsibilities.

Here are six flags that may make your tax return prime for an IRS audit.

The impact that Artificial Intelligence (AI) tools can have on retirees with a consulting or small business venture.

Social media may be a modern imperative for businesses looking to grow and build their brand, but it also introduces risk.

Assess how many days you'll work to pay your federal tax liability.

Use this calculator to estimate your income tax liability along with average and marginal tax rates.

Help determine the required minimum distribution from an IRA or other qualified retirement plan.

A bucket plan can help you be better prepared for a comfortable retirement.

Do you know how long it may take for your investments to double in value? The Rule of 72 is a quick way to figure it out.

Agent Jane Bond is on the case, cracking the code on bonds.